O’Reilly members experience live online training, plus books, videos, and digital content from nearly 200 publishers. Get Risk Assessment: Tools, Techniques, and Their Applications now with the O’Reilly learning platform. For instance, if you flip a coin, there are two possible ways it can land, either heads or tails. In order to understand probability, you must know how many possible ways a thing can happen. The probability of a risk occurring can range anywhere between 0 and 100 or it can be expressed as a number between 0 to 1. Īlthough these rules of probability are extremely few and simple, they are incredibly powerful in application. Risk Probability (sometimes known as likelihood) describes the potential for the risk event occurring.

Some textbooks will use mathematical symbols for the words “and” and “or” and the expression would look like.

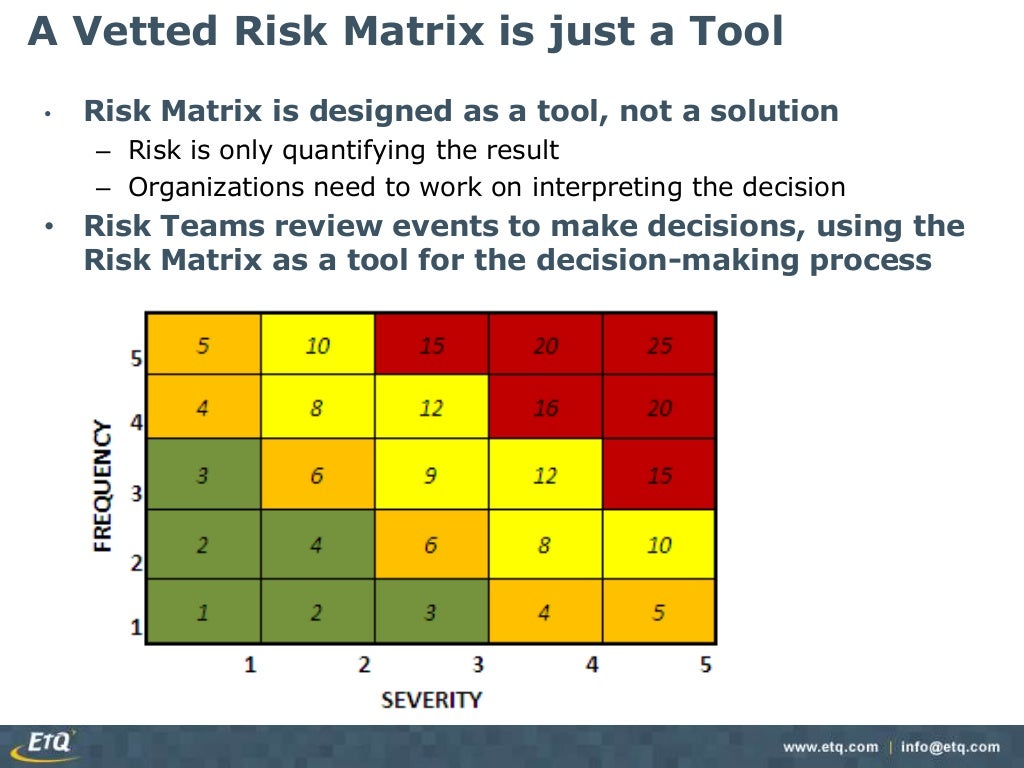

In this case, we express this as P(A or B) = P(A) + P(B). There is also a rule that applies to two events, A and B, which are mutually exclusive, that is, the two events cannot occur at the same time. In our discussion, we'll focus on rating risks using probability of occurrence and severity. Risk ratings and scaling can show where additional resources are required. Assessing risk of potential hazards helps to determine the proper mitigation strategy and priorities. This expression is the first basic rule of probability (3). Risk is the probability that a hazard will result in an adverse consequence. Another way to express this is 0 ≤ P(A) ≤ 1, where A is the event. Zero means that something cannot happen (impossible) and 1 or 100% means it is sure to happen. Probability is always a number between 0 and 1 or between 0% and 100%. Probability is usually expressed as a fraction with the denominator representing the total number of ways things can occur and the numerator representing the number of things that you are hoping will occur. Some other terms or words used in place of probability are chance, likelihood, uncertainty, and odds. Probability measures the uncertainty associated with the outcomes of a random experiment. Lastly, different calculation methods give different results.Įxpected shortfall, an alternative risk measure, aims at mitigating some of VAR’s flaws.Ĭlick here for articles on value-at-risk.Probability is defined as the likelihood that the event will occur. Secondly, it is not additive, so VAR figures of components of a portfolio do not add to the VAR of the overall portfolio, because this measure does not take correlations into account and a simple addition could lead to double counting. Firstly, while quantifying the potential loss within that level, it gives no indication of the size of the loss associated with the tail of the probability distribution out of the confidence level. The Monte Carlo method simulates large numbers of scenarios for the portfolio and determines VAR by observing the distribution of the resulting paths.ĭespite being widely used, VAR suffers from a number of drawbacks.

Risk probability definition series#

With the historical method, VAR is determined by taking the returns belonging to the lowest quintile of the series (identified by the confidence level) and observing the highest of those returns. Under the parametric method, also known as variance-covariance method, VAR is calculated as a function of mean and variance of the returns series, assuming normal distribution. VAR can be calculated using different techniques. For example, if the 95% one-month VAR is $1 million, there is 95% confidence that over the next month the portfolio will not lose more than $1 million. In everyday usage, risk is often used synonymously with probability of a loss or threat. It denotes a potential negative impact on an asset or some characteristic of value that may arise from some present process or some future event. It is defined as the maximum dollar amount expected to be lost over a given time horizon, at a pre-defined confidence level. A Probabilistic Safety Analysis expresses uncertainty about the possible future damaging consequences of complex installations, such as chemical or nuclear. The risk is a concept which relates to human expectations. Originally Answered: How can I explain the meaning of probability and loss as used in the operational definition of risk: risk probability of an event x. Value-at-risk is a statistical measure of the riskiness of financial entities or portfolios of assets.

0 kommentar(er)

0 kommentar(er)